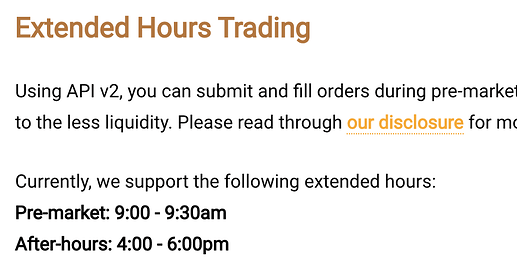

Per my understanding of the documentation, it appears that the trading calendar for Alpaca doesn't include extended hours. Any chance we can get this added for US equities?

Basically, when trading small cap stocks, many large gap mean reversion opportunities offer the best entry prices during pre-market trading. Or when trading earnings plays, the best price action is often after hours, during post-market trading. Any chance we can start live trading starting at 4am EST, through to 8pm EST, when using Alpaca/Polygon?

If I misunderstood the documentation, or if there's a workaround to accomplish trading extended hours, please let me know. Thanks!