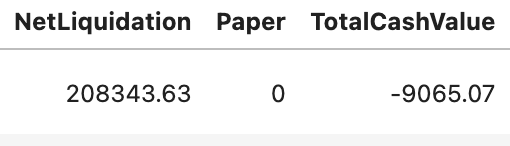

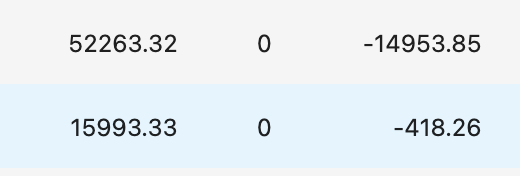

Account NLV is 53k, but is holding 68k (15k margin). Long-only.

Hypothesis: Rounding inside order_stubs_to_orders is causing this.

All tickers hold excess positions, but example given is AAPL.

AAPL held via blotter & broker: 29 shares. Moonshot calculations say it should hold ~20 shares.

There are no pending/cancelled/submitted orders.

Calculation:

Account NLV: 53k

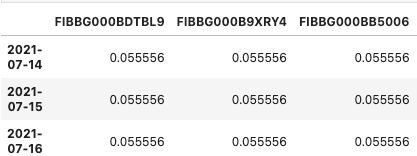

Target Weight: 0.055556

Algo allocation: 1.0

Trade Value: NLV * Weight: 53k * 0.055555 = $2944.44444

Price of Security: $142.00

Target Quantity: $2944.44444 / 142.00 = 20.73 shares

You can see in a moonshot dev the target-weights check out; 18 signals ~ 0.055556.

.

.

Positions just copy target weights: positions = target_weights.copy()

Based on the position size of 29, reverse engineering would say the target weight given by order_stubs_to_orders is:

29 shares * $142 = $4118.

$4118/53k = 0.0777 target weight.

Are there rounding functions being applied inside order_stubs_to_orders causing this?

I've had this algo dip margin minimally in the past, +-4% in order to maintain an equal-weighted portfolio self.allocate_equal_weights(), but 30% margin is excessive.