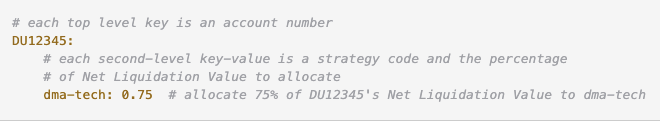

Is Alpaca based on Buying Power rather than Net Liquidation Value?

Only see IB specified here.

.

.

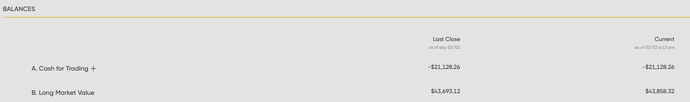

I have 1.0 specified inside quantrocket.moonshot.allocations.yml for the same strategy at IB & Alpaca, but Alpaca seems to be based off total buying power (~2X liquid cash), hence the leverage in the picture below.

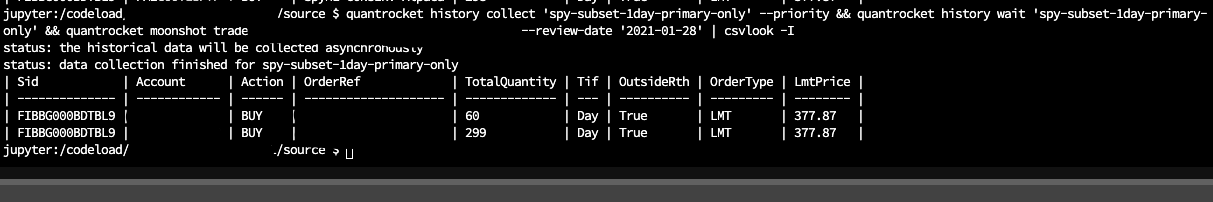

Now I'm less certain how the leverage happened. Here is a hypothetical trade on Jan 28th. Top order is the 60 * 377.87 = $22,672.20, which would make me assume Alpaca only picks up net liquidation value.